42+ is mortgage insurance tax deductible 2021

Web What is the maximum deduction for mortgage interest 2021. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below.

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures

Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders.

. Mortgage Insurance Tax Deduction Act of 2021. However higher limitations 1 million 500000 if married. Enter the Qualified mortgage insurance premiums paid on post 123106 contracts.

Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has. Web Go to Screen 25 Itemized Deductions. Insurance other than mortgage insurance premiums including fire and comprehensive coverage and title insurance.

A bill must be passed by both the House and Senate in identical form and then be signed by the. Web In December 2021 the Middle Class Mortgage Insurance Premium Act again sought to make the deduction permanent along with increasing the income threshold. Web Mortgage Insurance Tax Deduction Frequently Asked Questions.

That means this tax year single filers and married couples filing jointly can. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163 h 3 E and formerly reported on lines 10 and 16 as deductible. SOLVED by TurboTax 5857 Updated January 13 2023.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web You cant deduct any of the following items. Mortgage Insurance Tax Deduction Act of 2021.

Eligible borrowers with mortgage loans originated in 2018 2019 2020 and 2021 and who itemize may qualify. The summary below was written by the Congressional Research Service which is a. Web 43 minutes agoKey points.

The itemized deduction for mortgage. Web Text for HR2276 - 117th Congress 2021-2022. A SEP IRA allows self-employed workers to make tax-deductible contributions.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Today the limit is 750000. Scroll down to the Interest section.

Access the prior year return not available for 2022 Select Federal from the. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Can I deduct private mortgage insurance PMI or MIP.

2276 117th was a bill in the United States Congress. Any small-business owner or self-employed worker can open a.

Boneka Puppenschuhe Die Kleinsten Lederschuhe Der Welt

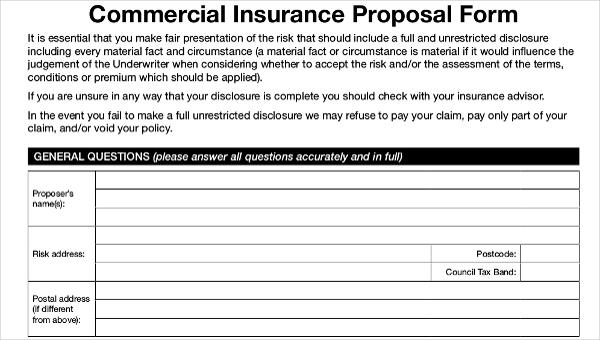

Free 49 Insurance Proposal Forms In Pdf Ms Word Excel

Mostly Money

Is Pmi Tax Deductible Credit Karma

Mes Business Strategy

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

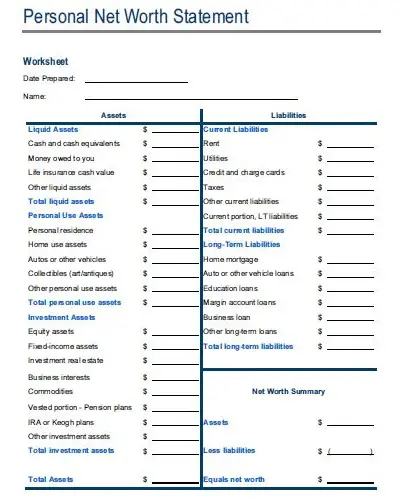

17 Free Personal Net Worth Statement Templates Template Republic

Is Mortgage Insurance Tax Deductible Bankrate

How Much Does Private Mortgage Insurance Pmi Cost Valuepenguin

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Powertrac Euro 42 Plus Tractor Price Specification Mileage 2023

Record Collector Issue 517 April 2021 Pdf Rock Music Funk

Is Mortgage Insurance Tax Deductible Bankrate

Health Justice Project Healthjusticepc Twitter

Is Mortgage Insurance Tax Deductible Bankrate